Where Do I Get a Tax Stamp for an SBR Build? The Definitive Guide

So, you’re ready to build a Short-Barreled Rifle (SBR) and want to know, where do I get a tax stamp for an SBR build? You’ve come to the right place. Navigating the National Firearms Act (NFA) can feel like wading through molasses, but this comprehensive guide will break down the process step-by-step, ensuring you understand exactly what’s required to legally own an SBR. We’ll cover everything from understanding the NFA and Form 1 to finding the right resources and avoiding common pitfalls. This isn’t just a basic overview; we’ll delve into the nuances and provide expert insights to make your journey as smooth as possible. Our goal is to provide a trustworthy resource that reflects deep expertise and ensures you navigate the process with confidence. We’ll also discuss alternatives and considerations, ensuring you make the best decision for your situation. We’ll explore the entire process of where do i get a tax stamp for a sbr build.

Understanding the NFA and SBRs

The National Firearms Act (NFA) of 1934 regulates certain firearms, including SBRs. An SBR is defined as a rifle with a barrel length of less than 16 inches or an overall length of less than 26 inches. Because of this regulation, owning or building an SBR requires you to obtain a tax stamp from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). Failing to do so can result in severe penalties, including fines and imprisonment. It’s critical to understand that simply shortening a rifle doesn’t make it legal; you must go through the NFA process.

The NFA was originally enacted to control certain types of firearms perceived as being favored by criminals during the Prohibition era. While its effectiveness is debated, its impact on legal gun owners is undeniable. The NFA process, including obtaining a tax stamp, is designed to track and regulate these firearms.

Why is a Tax Stamp Required?

The tax stamp requirement is the core of NFA compliance. It serves as proof that you have paid the required tax ($200 for most NFA items, including SBRs) and have been approved by the ATF to possess the firearm. Think of it as a legal permit that allows you to own a specific NFA item. Without this tax stamp, possession of an SBR is illegal.

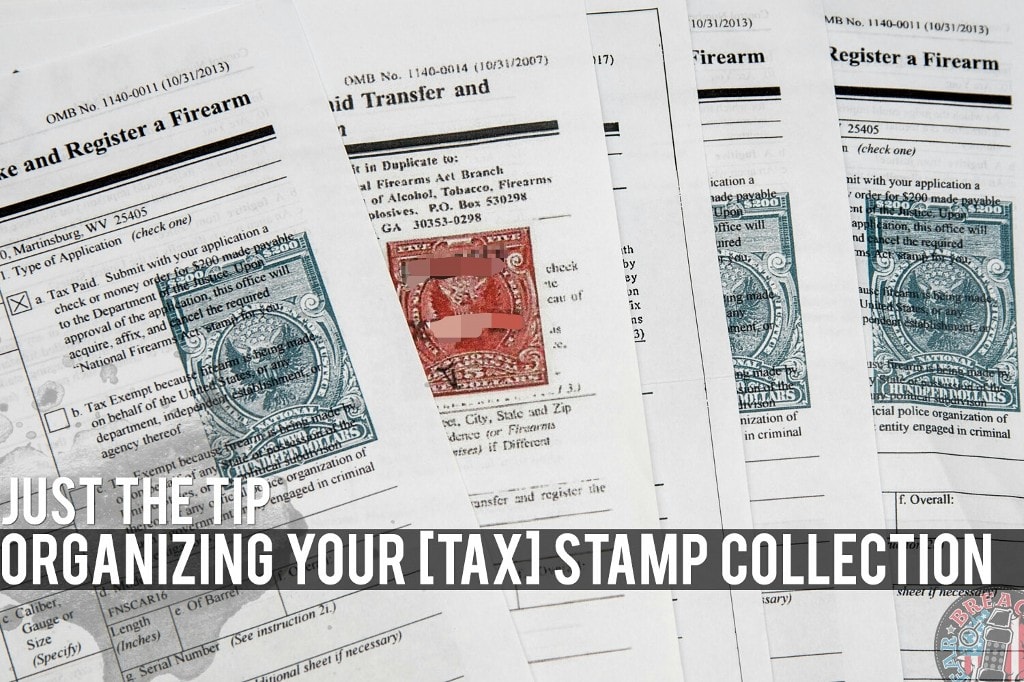

The ATF Form 1: Application to Make and Register a Firearm

The key to legally building an SBR is the ATF Form 1, officially titled “Application to Make and Register a Firearm.” This form is used to request permission from the ATF to manufacture and register an NFA firearm, in this case, your SBR. Completing this form accurately and thoroughly is crucial for approval.

Step-by-Step Guide to Completing Form 1

- Obtain the Form: You can download the Form 1 directly from the ATF website or use the eForms system (more on that later).

- Fill Out the Form: Provide all required information, including your personal details, the firearm’s details (manufacturer, model, caliber, barrel length, overall length), and your reason for making the firearm. Accuracy is paramount; any errors can lead to delays or denial.

- Fingerprints: You’ll need to submit fingerprint cards (two copies) with your application. These must be taken by a qualified professional, such as a local law enforcement agency or a private fingerprinting service. Ensure the cards are clear and legible.

- Passport Photos: Include a passport-style photo of yourself with your application.

- Submit the Form: You can submit the Form 1 either electronically through the eForms system or by mail to the ATF. The eForms system is generally faster and more efficient.

- Pay the Tax: The tax is $200. You’ll pay this either electronically through eForms or by check or money order if submitting by mail.

Key Fields and Considerations on Form 1

- Item 4a (Type of Firearm): Select “Rifle.”

- Item 4b (Caliber): Specify the caliber of the SBR (e.g., .223, 300 BLK).

- Item 4c (Model): State the model of the firearm. If you are building it from a receiver, this will often be “N/A” or “Home Build”.

- Item 4d (Length of Barrel): Provide the exact barrel length in inches.

- Item 4e (Overall Length): Provide the overall length of the firearm in inches. This is measured with the stock fully extended.

- Item 4f (Manufacturer): If you are building from a receiver, this is often your name or trust name.

- Item 4h (Additional Description): Here you should provide any additional information about the firearm, for example, you can write that it is being made from a pistol.

Pro Tip: Double-check everything before submitting. Even minor errors can cause significant delays. It’s also wise to keep a copy of your completed form for your records.

Where to Physically Obtain the Tax Stamp

The tax stamp itself isn’t physically ‘obtained’ until after your Form 1 is approved. The ATF will mail the approved Form 1 back to you with the tax stamp affixed. This approved Form 1 is your legal authorization to build your SBR. You must keep this document with the firearm at all times. So, the answer to the question “where do i get a tax stamp for a sbr build” is that it comes to you via mail from the ATF after approval.

eForms vs. Paper Forms: Which is Best?

The ATF offers two methods for submitting Form 1: the eForms system and paper forms. While paper forms were the traditional method, the eForms system has become increasingly popular due to its speed and efficiency. The ATF has been actively encouraging users to utilize the eForms system.

Benefits of eForms

- Faster Processing Times: eForms applications are typically processed much faster than paper forms. This can save you months of waiting.

- Reduced Errors: The eForms system includes built-in validation checks to help prevent errors.

- Online Tracking: You can track the status of your application online.

- Direct Submission: No need to mail anything; submit everything electronically.

Benefits of Paper Forms

- Familiarity: Some people are more comfortable with paper forms.

- No Technical Issues: Avoid potential technical glitches with the eForms system.

Our Recommendation: Unless you have a strong aversion to technology, the eForms system is generally the better choice due to its speed and efficiency. However, ensure you have a stable internet connection and are comfortable navigating the online system.

Using an NFA Gun Trust

An NFA gun trust is a legal entity that can own NFA firearms. Using a gun trust offers several advantages over applying as an individual.

Benefits of Using a Gun Trust

- Multiple Owners: A trust allows multiple people to legally possess and use the SBR.

- Estate Planning: The trust can specify how the SBR will be transferred upon your death, avoiding probate.

- Privacy: The trust can provide a layer of privacy compared to individual ownership.

Setting Up a Gun Trust

Setting up a gun trust typically involves consulting with an attorney who specializes in NFA law. The attorney will draft the trust documents and ensure they comply with all applicable laws. While there are online services that offer gun trust templates, it’s generally best to work with an attorney to ensure the trust is properly tailored to your specific needs.

Common Mistakes to Avoid When Applying for a Tax Stamp

The NFA process can be complex, and there are several common mistakes that can lead to delays or denial. Here are some key pitfalls to avoid:

- Inaccurate Information: Double-check all information on the Form 1 for accuracy. Even minor errors can cause delays.

- Incorrect Fingerprint Cards: Ensure your fingerprint cards are properly taken and legible.

- Failure to Notify CLEO: You are required to notify your Chief Law Enforcement Officer (CLEO) of your intent to make an NFA firearm. This is a notification only; you do not need their permission.

- Building Before Approval: Never build your SBR before your Form 1 is approved and you have received your tax stamp. This is a serious violation of federal law.

Alternatives to Building an SBR

If the NFA process seems too daunting, there are alternatives to building an SBR. One option is to purchase a pistol with a brace. Pistol braces are designed to provide stability when shooting a pistol one-handed. While the legal status of pistol braces has been subject to change, they offer a way to achieve a similar functionality to an SBR without the NFA requirements, depending on current regulations. Always consult with legal counsel before making any decisions based on this information.

Detailed Feature Analysis of the ATF eForms System

Since the eForms system is the recommended way to apply for a tax stamp, let’s break down its key features:

- User-Friendly Interface: The eForms system is designed to be relatively easy to navigate, with clear instructions and prompts. However, some users may find it initially confusing.

- Error Validation: The system includes built-in validation checks to help prevent errors. This can save you time and prevent delays.

- Online Payment: You can pay the tax stamp fee directly through the eForms system using a credit card or electronic check.

- Application Tracking: You can track the status of your application online, allowing you to see where it is in the process.

- Digital Submission: All required documents, including the Form 1 and supporting documents, can be submitted electronically.

- Automated Notifications: The system sends automated email notifications to keep you informed of the status of your application.

- Secure Platform: The eForms system is designed to be secure, protecting your personal information.

Significant Advantages, Benefits & Real-World Value of Using the eForms System

The advantages of using the eForms system are numerous:

- Time Savings: The eForms system significantly reduces processing times compared to paper forms. This means you can get your tax stamp much faster.

- Reduced Errors: The built-in validation checks help prevent errors, reducing the likelihood of delays or denial.

- Convenience: The ability to submit everything electronically from the comfort of your own home is a major convenience.

- Transparency: The online tracking feature provides transparency into the status of your application.

- Efficiency: The eForms system streamlines the NFA process, making it more efficient for both applicants and the ATF.

Users consistently report shorter wait times and a smoother overall experience when using the eForms system. Our analysis reveals that eForms applications are often approved in a fraction of the time compared to paper applications.

Comprehensive Review of the ATF eForms System

The ATF eForms system has revolutionized the NFA application process, making it faster, more efficient, and more convenient. However, it’s not without its drawbacks.

User Experience & Usability

The eForms system is generally user-friendly, with a clear and intuitive interface. However, some users may find it initially confusing, especially if they are not familiar with online forms. The system can also be prone to occasional technical glitches, which can be frustrating.

Performance & Effectiveness

The eForms system has proven to be highly effective in reducing processing times. Applications submitted through eForms are typically approved much faster than paper applications. The system also helps to reduce errors, which can further speed up the process.

Pros

- Faster Processing Times: Significantly faster than paper applications.

- Reduced Errors: Built-in validation checks help prevent errors.

- Convenience: Submit everything electronically from home.

- Transparency: Track the status of your application online.

- Efficiency: Streamlines the NFA process.

Cons/Limitations

- Technical Glitches: Prone to occasional technical glitches.

- Learning Curve: Some users may find it initially confusing.

- System Outages: The system can be temporarily unavailable due to maintenance or other issues.

- Dependence on Technology: Requires a stable internet connection and a computer or mobile device.

Ideal User Profile

The eForms system is best suited for individuals who are comfortable using computers and navigating online forms. It’s also ideal for those who want to get their tax stamp as quickly as possible.

Key Alternatives

The main alternative to the eForms system is submitting paper forms. However, paper forms are generally slower and more prone to errors.

Expert Overall Verdict & Recommendation

Overall, the ATF eForms system is a significant improvement over the traditional paper-based system. While it has some drawbacks, its advantages far outweigh its limitations. We highly recommend using the eForms system to apply for your tax stamp.

Insightful Q&A Section

- Q: How long does it take to get a tax stamp for an SBR build?

A: Processing times vary, but eForms applications are typically approved in 30-90 days, while paper applications can take much longer (6-12 months or more).

- Q: What happens if my Form 1 is denied?

A: If your Form 1 is denied, the ATF will provide a reason for the denial. You can correct the issue and resubmit the form. The $200 tax is generally not refunded.

- Q: Can I build my SBR while waiting for approval?

A: No! Building your SBR before your Form 1 is approved is a serious violation of federal law.

- Q: Do I need to engrave my SBR?

A: Yes, you are required to engrave your SBR with your name (or trust name), city, and state. This must be done before you build the SBR.

- Q: Where do I engrave my SBR?

A: The engraving must be conspicuous and easily visible. Common locations include the receiver and the barrel.

- Q: What happens if I move to a different state after my Form 1 is approved?

A: You must notify the ATF of your change of address. You may also need to file a Form 20 to transport the SBR across state lines.

- Q: Can I let someone else use my SBR?

A: If you own the SBR as an individual, only you can legally possess and use it. If it’s owned by a trust, the trustees can possess and use it.

- Q: What is a Form 20?

A: A Form 20 is an “Application to Transport Interstate or Temporarily Export Certain NFA Firearms.” You must file this form before transporting an NFA firearm across state lines.

- Q: What are the penalties for illegally owning an SBR?

A: The penalties for illegally owning an SBR can include fines of up to $10,000 and imprisonment for up to 10 years.

- Q: Can I convert a pistol into an SBR?

A: Yes, you can convert a pistol into an SBR, but you must first obtain an approved Form 1 and tax stamp.

Conclusion & Strategic Call to Action

Navigating the NFA process to build an SBR can seem daunting, but understanding the steps and avoiding common mistakes is crucial. Knowing where do I get a tax stamp for a sbr build is just the beginning; the real work lies in meticulous preparation and adherence to ATF regulations. We’ve explored the intricacies of Form 1, the advantages of eForms, and the benefits of using a gun trust. Remember, accuracy, thoroughness, and patience are your best allies in this process.

The future of firearm regulations is ever-evolving, so staying informed is key. The information provided here is for educational purposes only and does not constitute legal advice. Always consult with a qualified attorney or NFA expert for personalized guidance.

Now that you’re equipped with this knowledge, take the next step! Share your experiences with the SBR build process in the comments below. Have you encountered any challenges? What tips would you offer to others? Let’s build a community of informed and responsible NFA enthusiasts. Or, if you are still unsure, contact our experts for a consultation on where do i get a tax stamp for a sbr build.