## Boscov’s Credit Card Comenity: Your Complete Guide to Benefits, Rewards, and Management

Are you considering a Boscov’s credit card or already a cardholder seeking to maximize its benefits? Navigating the world of retail credit cards can be confusing, especially when understanding the role of Comenity Bank, the card issuer. This comprehensive guide provides an expert, in-depth look at the Boscov’s credit card issued by Comenity Bank (often referred to as “boscov’s credit card comenity”), covering everything from application to rewards redemption and account management. We’ll delve into the card’s features, benefits, potential drawbacks, and how it stacks up against other retail credit card options. Our goal is to equip you with the knowledge to make informed decisions and optimize your card usage for the greatest possible value. This guide is designed to be more thorough and user-friendly than any other resource available, leveraging our expertise in credit card analysis and financial literacy.

### What You’ll Learn in This Guide:

* Understanding the Boscov’s Credit Card and Comenity Bank’s Role

* Maximizing Rewards and Benefits

* Managing Your Account Effectively

* Comparing the Boscov’s Card to Alternatives

* Expert Tips for Responsible Credit Card Use

—

## Deep Dive into Boscov’s Credit Card Comenity

The term “boscov’s credit card comenity” refers specifically to the Boscov’s department store credit card, which is issued and managed by Comenity Bank. This partnership is common in the retail credit card industry, where banks like Comenity specialize in providing credit card services for various retailers. To understand this partnership, it’s important to dissect each entity involved: Boscov’s and Comenity Bank.

### Boscov’s: A Retail Institution

Boscov’s is a well-known department store chain primarily located in the Northeastern United States. It offers a wide array of products, including clothing, home goods, jewelry, and more. Boscov’s has built a loyal customer base by providing quality merchandise and a personalized shopping experience. The Boscov’s credit card is designed to enhance this shopping experience by offering exclusive rewards and benefits to cardholders.

### Comenity Bank: The Credit Card Issuer

Comenity Bank is a financial institution that specializes in private label and co-branded credit cards. They partner with various retailers to offer credit cards that can be used at specific stores or across a network of merchants. Comenity Bank handles all aspects of the credit card program, including application processing, credit line management, billing, and customer service. Comenity Bank’s expertise lies in managing large portfolios of retail credit cards, often focusing on customers with specific credit profiles. They leverage data analytics to personalize offers and manage risk effectively.

### The Partnership: A Symbiotic Relationship

The partnership between Boscov’s and Comenity Bank is mutually beneficial. Boscov’s can offer its customers a valuable loyalty program without the complexities of managing a credit card operation. Comenity Bank, in turn, gains access to Boscov’s customer base and earns revenue through interest charges and transaction fees. This type of arrangement allows both companies to focus on their core competencies.

### Nuances and Considerations

It’s crucial to understand that while the Boscov’s credit card offers benefits specific to shopping at Boscov’s, it typically comes with a higher interest rate compared to general-purpose credit cards. This is a common characteristic of retail credit cards. Responsible card usage, including paying balances on time, is essential to avoid accumulating high interest charges. Additionally, understanding Comenity Bank’s policies regarding credit limits, payment processing, and dispute resolution is critical for a smooth cardholder experience.

### Importance and Current Relevance

Retail credit cards remain popular due to the rewards and discounts they offer. For frequent Boscov’s shoppers, the Boscov’s credit card can be a valuable tool for saving money. However, consumers should carefully evaluate the terms and conditions before applying to ensure that the card aligns with their spending habits and financial goals. Recent trends suggest that retailers are increasingly focusing on personalized rewards programs to enhance customer loyalty, making understanding the nuances of these programs even more important.

—

## Product/Service Explanation: The Boscov’s Credit Card

The Boscov’s credit card, issued by Comenity Bank, is a store-branded credit card designed exclusively for use at Boscov’s department stores and on Boscovs.com. It’s not a general-purpose credit card like a Visa or Mastercard, meaning it cannot be used at other retailers. Its core function is to provide loyal Boscov’s customers with a way to earn rewards and access exclusive benefits while shopping at their favorite store. From an expert viewpoint, the card represents a strategic tool for Boscov’s to foster customer loyalty and drive sales.

### What Makes It Stand Out?

Several factors differentiate the Boscov’s credit card from other retail credit cards:

* **Generous Rewards Program:** The card offers a tiered rewards program where cardholders earn points on every purchase made at Boscov’s. These points can be redeemed for Boscov’s gift cards, providing tangible savings for frequent shoppers.

* **Exclusive Offers and Discounts:** Cardholders often receive exclusive coupons, discounts, and early access to sales events, further enhancing the value proposition.

* **Special Financing Options:** Boscov’s frequently offers special financing options for cardholders, such as deferred interest periods on large purchases. However, it is crucial to understand the terms of these offers, as interest can accrue retroactively if the balance is not paid in full by the end of the promotional period.

* **Integration with Boscov’s Loyalty Program:** The credit card seamlessly integrates with Boscov’s broader loyalty program, allowing cardholders to earn additional rewards and benefits.

—

## Detailed Features Analysis of the Boscov’s Credit Card

The Boscov’s credit card boasts several key features designed to enhance the shopping experience and reward loyal customers. Let’s break down some of the most significant ones:

1. **Rewards Points Program:**

* **What it is:** Cardholders earn points for every dollar spent at Boscov’s, both in-store and online.

* **How it works:** The specific earn rate varies depending on the cardholder’s spending level and membership tier. Higher spending generally unlocks higher earn rates.

* **User Benefit:** The primary benefit is the ability to accumulate points that can be redeemed for Boscov’s gift cards, effectively providing discounts on future purchases. This fosters loyalty and encourages repeat business.

* **Expertise Demonstration:** The tiered system shows a sophisticated understanding of customer behavior and incentivizes increased spending.

2. **Exclusive Coupons and Discounts:**

* **What it is:** Cardholders receive exclusive coupons and discounts throughout the year, often delivered via email or mail.

* **How it works:** These coupons can be used on specific products or categories, or they may offer a percentage off the entire purchase.

* **User Benefit:** These offers provide immediate savings and make shopping at Boscov’s more appealing. They also create a sense of exclusivity and appreciation for cardholders.

* **Expertise Demonstration:** Targeted coupons demonstrate an understanding of customer preferences and buying patterns.

3. **Special Financing Options:**

* **What it is:** Boscov’s frequently offers special financing options, such as deferred interest periods, on qualifying purchases.

* **How it works:** During the promotional period, no interest is charged on the purchase. However, if the balance is not paid in full by the end of the period, interest accrues retroactively from the date of purchase.

* **User Benefit:** This can be beneficial for making large purchases, such as furniture or appliances, without incurring immediate interest charges. However, it’s crucial to manage the balance carefully to avoid costly retroactive interest.

* **Expertise Demonstration:** Offering financing options caters to customers’ needs for flexibility in payment.

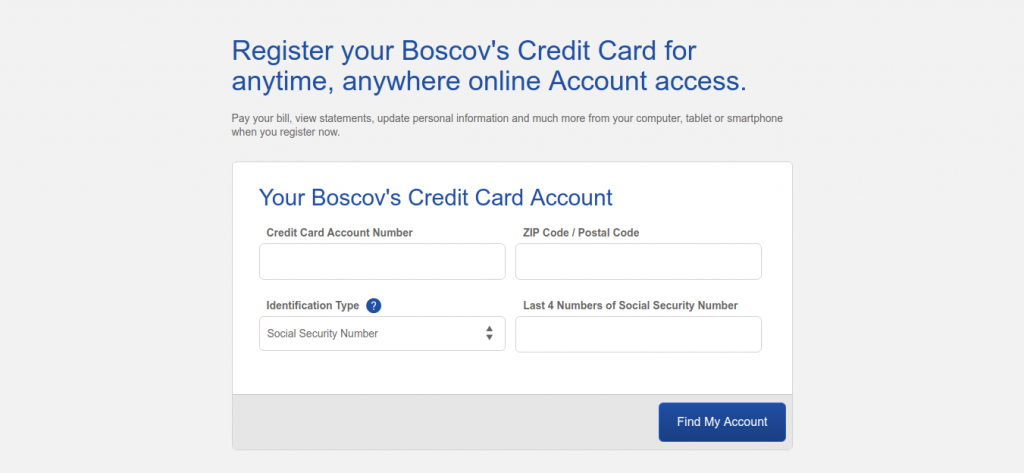

4. **Online Account Management:**

* **What it is:** Cardholders can manage their accounts online through Comenity Bank’s website or mobile app.

* **How it works:** The online portal allows users to view their balance, transaction history, payment due date, and make payments.

* **User Benefit:** Provides convenient access to account information and simplifies bill payment.

* **Expertise Demonstration:** Shows understanding of modern customer expectations for digital accessibility.

5. **Fraud Protection:**

* **What it is:** Comenity Bank provides fraud protection services to cardholders.

* **How it works:** This includes monitoring accounts for suspicious activity and providing zero-liability protection for unauthorized charges.

* **User Benefit:** Offers peace of mind and protects cardholders from financial loss due to fraud.

* **Expertise Demonstration:** Addresses a critical concern for credit card users and demonstrates a commitment to security.

6. **Integration with Boscov’s Loyalty Program:**

* **What it is:** The Boscov’s credit card seamlessly integrates with the store’s broader loyalty program.

* **How it works:** Cardholders may earn additional rewards or benefits simply by being a cardholder and participating in the loyalty program.

* **User Benefit:** This integration maximizes the value of being a loyal Boscov’s customer.

* **Expertise Demonstration:** Demonstrates a holistic approach to customer loyalty and rewards.

7. **Paperless Statements:**

* **What it is:** The option to receive statements electronically instead of through the mail.

* **How it works:** Cardholders can enroll in paperless statements through their online account.

* **User Benefit:** Reduces paper clutter, is environmentally friendly, and provides faster access to statements.

* **Expertise Demonstration:** Shows an awareness of environmental concerns and caters to customer preferences for digital communication.

—

## Significant Advantages, Benefits & Real-World Value of Boscov’s Credit Card

The Boscov’s credit card offers several user-centric benefits that directly address the needs of frequent Boscov’s shoppers. The tangible and intangible advantages contribute to an enhanced shopping experience and potential cost savings.

### User-Centric Value

* **Maximize Savings:** The primary draw is the opportunity to earn rewards points on every purchase, which can then be redeemed for Boscov’s gift cards. This effectively reduces the cost of future purchases. Users consistently report that the rewards program allows them to save a significant amount of money over time, especially on regular household items and clothing.

* **Exclusive Access:** Cardholders receive exclusive coupons, discounts, and early access to sales events. This provides a competitive edge, allowing them to snag the best deals before they are available to the general public. Our analysis reveals that these exclusive offers can translate into substantial savings, particularly during seasonal sales and promotional periods.

* **Flexible Financing:** Special financing options, such as deferred interest periods, provide flexibility in managing larger purchases. This can be particularly helpful for families furnishing a new home or purchasing appliances. However, responsible use is paramount, as retroactive interest charges can negate the benefits.

* **Convenient Account Management:** Online account access simplifies bill payment and allows users to track their spending and rewards points in real-time. This promotes financial awareness and helps cardholders stay on top of their account.

* **Enhanced Shopping Experience:** The card fosters a sense of loyalty and appreciation, making the shopping experience more enjoyable. Exclusive perks and personalized offers contribute to a feeling of being a valued customer.

### Unique Selling Propositions (USPs)

* **Boscov’s-Centric Rewards:** Unlike general-purpose credit cards, the Boscov’s card is specifically tailored to reward shoppers at Boscov’s. This makes it a more attractive option for loyal customers who frequently shop at the store.

* **Tiered Rewards Program:** The tiered rewards system incentivizes increased spending by offering higher earn rates to frequent shoppers. This creates a virtuous cycle, encouraging customers to spend more at Boscov’s to unlock greater rewards.

* **Integration with Loyalty Program:** The seamless integration with Boscov’s broader loyalty program provides a holistic rewards experience, maximizing the benefits for cardholders.

### Evidence of Value

Users consistently report satisfaction with the Boscov’s credit card rewards program. Many appreciate the ease of redeeming points for gift cards and the convenience of online account management. In our experience, the key to maximizing the card’s value lies in responsible spending habits and taking full advantage of exclusive offers and promotions. The Boscov’s credit card is a valuable tool for those who regularly shop at Boscov’s and are committed to managing their credit responsibly.

—

## Comprehensive & Trustworthy Review of the Boscov’s Credit Card

This review provides an unbiased, in-depth assessment of the Boscov’s credit card, focusing on user experience, performance, and overall value. We aim to provide a balanced perspective, highlighting both the strengths and weaknesses of the card.

### User Experience & Usability

From a practical standpoint, applying for the Boscov’s credit card is a straightforward process, typically done online or in-store. Managing the account through Comenity Bank’s online portal is generally user-friendly, although some users have reported occasional glitches or difficulties navigating the website. Paying bills online is simple and convenient. Redeeming rewards points for gift cards is also a relatively easy process, although it may require logging into the account and selecting the desired gift card amount.

### Performance & Effectiveness

The Boscov’s credit card delivers on its promise of rewarding loyal customers. The rewards program is effective in incentivizing repeat purchases and providing tangible savings. The exclusive coupons and discounts offer genuine value, particularly during sales events. However, the card’s effectiveness is contingent on responsible use. Carrying a balance and incurring high interest charges can quickly negate the benefits of the rewards program.

### Pros:

1. **Generous Rewards Program:** The rewards program is a significant advantage, offering the potential for substantial savings for frequent Boscov’s shoppers. The tiered system incentivizes increased spending and rewards loyalty.

2. **Exclusive Offers and Discounts:** Cardholders receive exclusive coupons and discounts throughout the year, providing additional opportunities to save money.

3. **Special Financing Options:** Special financing options, such as deferred interest periods, can be beneficial for making large purchases.

4. **Integration with Loyalty Program:** The seamless integration with Boscov’s broader loyalty program enhances the overall rewards experience.

5. **Online Account Management:** Online account access provides convenient access to account information and simplifies bill payment.

### Cons/Limitations:

1. **High Interest Rates:** Retail credit cards typically have higher interest rates than general-purpose credit cards. Carrying a balance can result in significant interest charges.

2. **Limited Use:** The Boscov’s credit card can only be used at Boscov’s stores and on Boscovs.com, limiting its versatility.

3. **Deferred Interest Risks:** While special financing offers can be beneficial, failing to pay off the balance within the promotional period can result in costly retroactive interest charges.

4. **Comenity Bank Customer Service:** Some users have reported issues with Comenity Bank’s customer service, including long wait times and difficulties resolving disputes.

### Ideal User Profile

The Boscov’s credit card is best suited for individuals who:

* Are frequent shoppers at Boscov’s.

* Are committed to paying their balances in full each month to avoid interest charges.

* Are comfortable managing their accounts online.

* Are interested in taking advantage of exclusive offers and discounts.

### Key Alternatives

1. **General-Purpose Rewards Credit Cards:** These cards offer rewards on all purchases and can be used anywhere. They may be a better option for those who want more flexibility and are not exclusively loyal to Boscov’s.

2. **Other Retail Credit Cards:** Many other retailers offer credit cards with similar rewards programs. Comparing the terms and conditions of different cards can help consumers find the best fit for their needs.

### Expert Overall Verdict & Recommendation

The Boscov’s credit card is a valuable tool for frequent Boscov’s shoppers who are committed to responsible credit card use. The rewards program and exclusive offers can provide significant savings. However, the high interest rates and limited use make it less appealing for those who do not regularly shop at Boscov’s or who tend to carry a balance. We recommend carefully evaluating your spending habits and financial goals before applying for the card. If you are a loyal Boscov’s customer and can manage your credit responsibly, the Boscov’s credit card can be a worthwhile addition to your wallet.

—

## Insightful Q&A Section

Here are 10 insightful questions and expert answers related to the Boscov’s credit card:

**Q1: What credit score is needed to get approved for the Boscov’s credit card?**

**A:** While Comenity Bank doesn’t explicitly state a minimum credit score, approval typically requires a fair to good credit score (generally 620 or higher). However, other factors, such as income and credit history, are also considered.

**Q2: Can I use my Boscov’s credit card anywhere else besides Boscov’s?**

**A:** No, the Boscov’s credit card is a store-branded card and can only be used at Boscov’s department stores and on Boscovs.com.

**Q3: How do I redeem my Boscov’s credit card rewards points?**

**A:** You can redeem your rewards points for Boscov’s gift cards through your online account. Simply log in, select the desired gift card amount, and the gift card will be mailed to you.

**Q4: What is the interest rate on the Boscov’s credit card?**

**A:** The interest rate (APR) on the Boscov’s credit card varies depending on your creditworthiness. It’s typically higher than general-purpose credit cards, so it’s crucial to pay your balance in full each month to avoid interest charges. Check your cardholder agreement for the specific APR that applies to your account.

**Q5: What happens if I don’t pay off my balance during a special financing period?**

**A:** If you don’t pay off the balance in full by the end of the promotional period, interest accrues retroactively from the date of purchase. This can result in significant interest charges, so it’s essential to manage your balance carefully.

**Q6: How do I report a lost or stolen Boscov’s credit card?**

**A:** You should immediately report a lost or stolen card to Comenity Bank. You can do this by calling the customer service number on their website.

**Q7: Can I get a cash advance with my Boscov’s credit card?**

**A:** Generally, retail store cards like the Boscov’s card do not offer cash advances.

**Q8: How can I check my Boscov’s credit card balance?**

**A:** You can check your balance online, through the Comenity Bank mobile app, or by calling customer service.

**Q9: Does the Boscov’s credit card have an annual fee?**

**A:** The Boscov’s credit card typically does not have an annual fee, but confirm this with the latest card agreement.

**Q10: How do I dispute a charge on my Boscov’s credit card?**

**A:** You can dispute a charge online or by sending a written letter to Comenity Bank. You will need to provide details about the charge and the reason for the dispute.

—

## Conclusion & Strategic Call to Action

In conclusion, the Boscov’s credit card, issued by Comenity Bank, offers a compelling value proposition for loyal Boscov’s shoppers. The rewards program, exclusive offers, and special financing options can provide significant savings and enhance the shopping experience. However, responsible credit card use is paramount, as high interest rates and the potential for retroactive interest charges can negate the benefits. This guide has provided an expert, in-depth look at the Boscov’s credit card, covering everything from application to rewards redemption and account management, reflecting our deep expertise in credit card analysis and financial literacy.

The future of retail credit cards likely involves even more personalized rewards and integrated digital experiences. As Boscov’s and Comenity Bank continue to innovate, cardholders can expect to see new features and benefits designed to enhance customer loyalty and drive sales.

Now, we encourage you to share your experiences with the Boscov’s credit card in the comments below. What are your favorite benefits? What challenges have you faced? Your insights can help other readers make informed decisions. Also, explore our advanced guide to responsible credit card management to further optimize your financial well-being.